Home improvement Programs

The house Improvement Applications help homeowners and you can landlords during the Wichita that have important house fixes so you’re able to existing structures in order to maintain safe, suit and you can reasonable casing options from inside the Wichita to benefit reasonable and you can modest money properties.

Individuals have to individual the home, are now living in the home, become most recent to your assets taxation, keeps homeowner’s insurance as well as have a being qualified earnings getting eligible.

All of the apps would be analyzed, and you will eligible plans was allotted to a delay list established for the feeling so you can health and safety, prior utilization of the program, and alignment together with other system goals. Immediately following an eligible investment are at the top of the latest hold off checklist, personnel have a tendency to get in touch with individuals to consult even more files to prove qualifications and commence the project. Almost every other eligibility factors implement and will be analyzed because the systems try vetted for latest acceptance.

- House Fix System

- Rental Rehab Financing System

- Historical Loan Program

Home Repair System

- Stabilize property owners within first tool out-of quarters, assisting to your goal of sustaining sensible homeownership.

- Assist with vital repairs having existing affordable property devices in order to maintain and keep maintaining they given that sensible houses stock from inside the Urban area.

Our home Resolve program will bring around $twenty five,000 during the direction to possess tactics and help with health, shelter, and you can precautionary fix need.

- Earliest Repairs allow for up to $5,000 when you look at the direction to possess important family fixes, such as drinking water solution and you may sewer line updates, heater and you can hot-water heater substitutes or any other key enhancements.

- Total Solutions will assist residents which have several or complex methods, or methods one exceed $5,000 during the difficult will cost you, as much as a maximum of $twenty-five,000 each home. A lead exposure analysis have to be presented and you will acknowledged tactics must target any points identified, also remediate open code abuses. Homeowners are required to provide a ten% match for everyone loans more than $5,000.

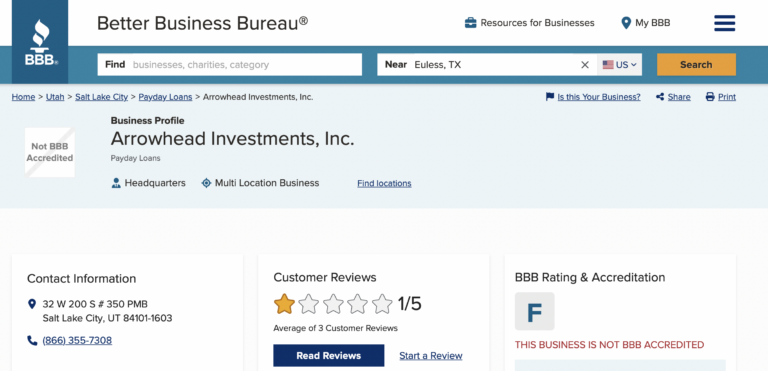

- Do it yourself Financing System finance is also subsidize the speed to possess individual home improvement loans by providing as much as a beneficial $5,000 grant to help you “get off” the speed to as little as 2 percent.

- Lead-dependent paint statutes connect with most of the program selection.

More system conditions and you may constraints implement. Brand new City’s capacity to assistance to a venture can be minimal by the extent, cost, loans available, lead otherwise environment danger understood, and other factors.

Leasing Rehabilitation Loan Program – Already Signed

Money is provided to proper below average requirements, create important developments, repair significant possibilities at risk for incapacity, take on advancements linked to energy savings, and you may boost accessibility. On end, the whole housing construction must conform to the minimum homes code.

A lot more financial support, in the way of a no-desire deferred fee mortgage, is offered to target lead-mainly payday loans based painting conditions. It financing flow from and you may payable up on new business of possessions or import regarding control.

Applicant residents should have enough guarantee throughout the possessions. Applicants must have a credit score free of outstanding borrowing from the bank obligations, late repayments, charge-offs, and you can financing standard occurrences. This new applicant’s credit score have to be 640 or greater, together with real estate tax money about the subject possessions have to getting newest.

Historical Financing System

From Historic Loan Program, low-appeal installment money are given on preservation, repairs, and you will rehabilitation off typically and you may architecturally significant formations discovered inside the Town of Wichita.

So you’re able to be considered, the property must be designated and listed since a great landmark from the nearby, state, otherwise national historical check in, getting a contributing structure when you look at the a residential area, or perhaps be into the 1919 urban area limits. Phone call the newest Urban Area Considered Company for more information. Make sure to feel the real possessions target offered. The mortgage candidate must also function as the holder of the house or need to be getting the assets towards a legitimate homes product sales package.

A lot more financing, when it comes to a zero-attention deferred percentage mortgage, is generally wanted to target direct-centered color conditions. That it financing is due and you may payable abreast of the brand new product sales of the assets otherwise import regarding control.

Renters shouldn’t be displaced. Residents must agree to book complete devices to people and you can/otherwise group with profits less than 80% of your own town average earnings having a period of 12 months. Monthly rent along with resources might not surpass 31% of occupant/occupant’s gross monthly money, upon occupancy.